Zacks Quant Lab applications are designed to work seamlessly with whatever data set you have – Zacks data, proprietary/custom data or third party data.

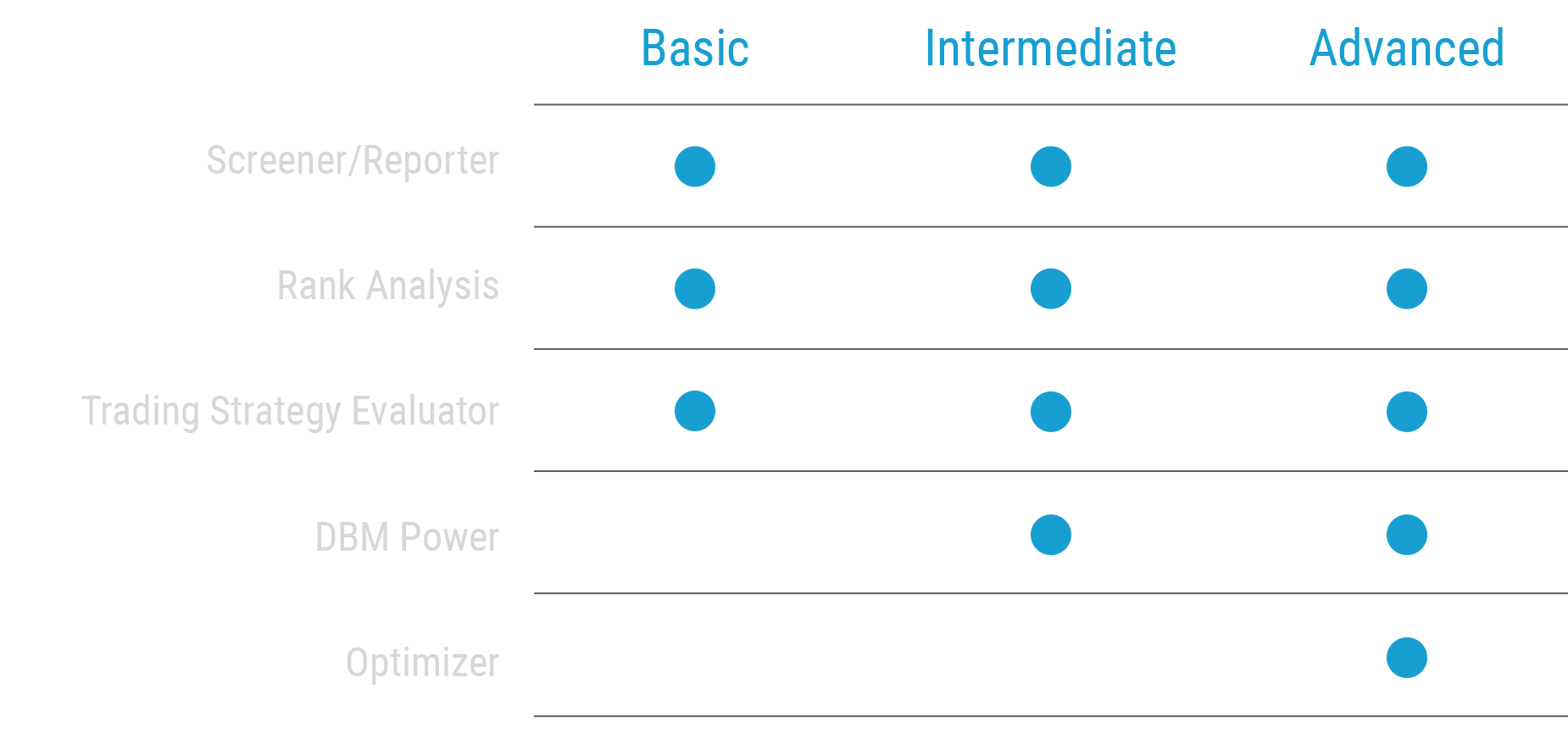

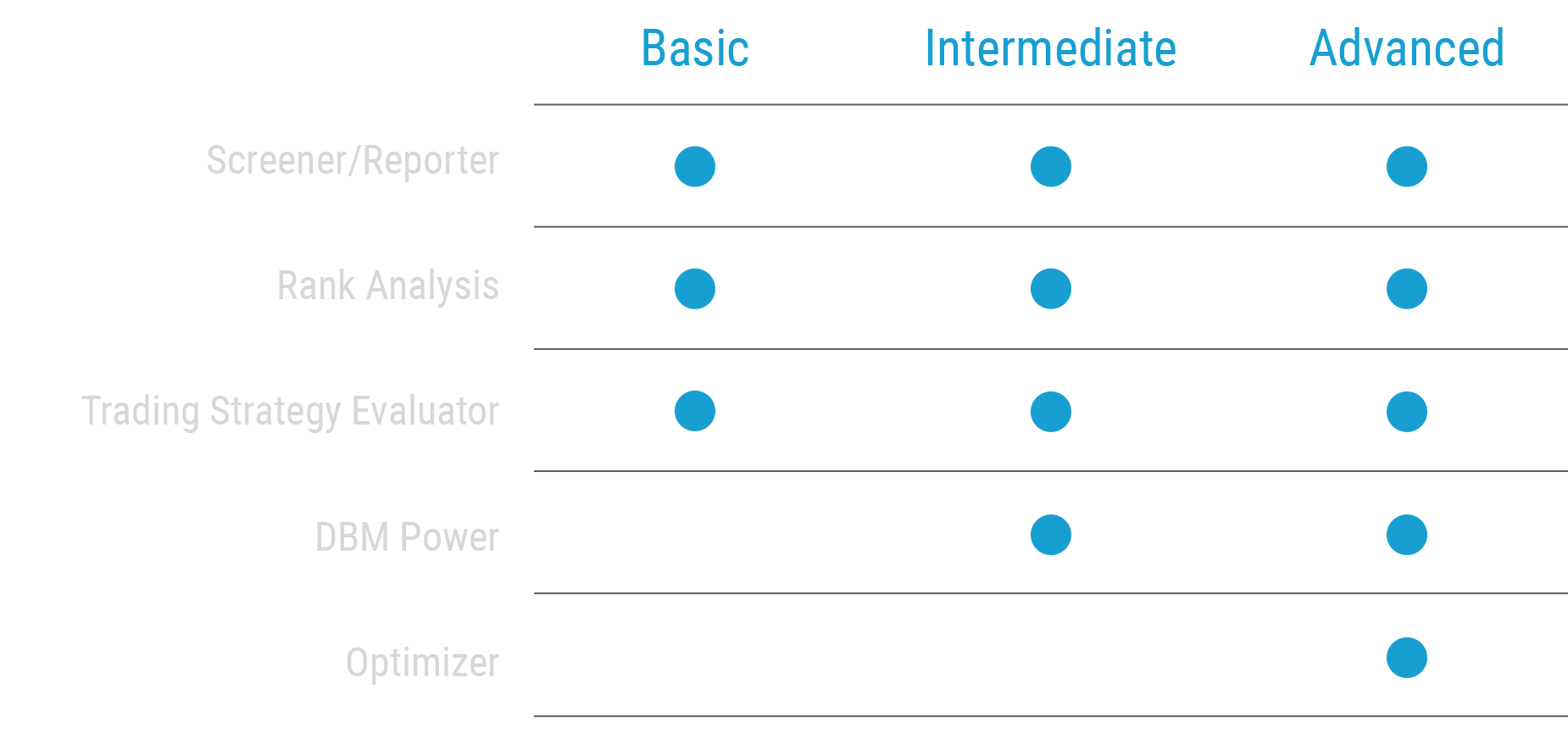

Choose the Best Software Package Based on Your Needs:

Zacks Quant Lab applications are designed to work seamlessly with whatever data set you have – Zacks data, proprietary/custom data or third party data.

Zacks Screener/Reporter is our base level screening and report writing software that filters stocks based on any given set of criteria – lowest P/E within a given sector, for example – and generates reports for any given list of stocks. Any ticker list or screen can be used as a starting point, which allows users to choose from their own universe of pre-defined stocks.

Backtest new strategies, or enhance existing ones, with powerful software designed to reveal which metrics are likely to yield the best returns. Rank Analysis is used to assess the correlation between variables. For example, users can quantify the relationship between the P/E ratio and stocks’ holding period return, or price-to-book ratio by sector and holding period return.

All these tools can be integrated to enhance your specific workflow. Whether you are using our databases or your own custom data, these tools will help you concoct the perfect formula for success.

Extend the backtest experience with our flexible, easy-to-use trading simulator utilizing such criteria as buy/sell rules, commissions/slippage, maximum number of positions, weighting tolerance, optimization constraints, rebalancing frequency and more.

Our data warehousing software has been a client solution for custom database creation, modification and maintenance for over 20 years. It’s easily adaptable to suit any quantitative environment and critical for backtesting and model building.

Use DBM Power for model building; group averages/medians; group weighted average; moving averages; regression analysis and more. You can also create conditional items, i.e., “if the stock is in the Utility sector, then exclude from the average.”

“Optimization” does exactly what it says: it lets you push the envelope to pursue the optimum balance of a portfolio’s risk and return characteristics. Zacks has partnered with Infanger Investment Technology, LLC, to incorporate advanced methodologies into our optimization software. Select the combination that seeks the lowest attainable risk for a given return, or the highest attainable return for a given level of risk.

Zacks Excel Link is our Excel spreadsheet add-on program that links all of the data in our databases (or yours!). Combining our data with the mathematical capability of Excel gives you a powerful tool for model building, valuation modeling, bottom-up analysis, at-a-glance general assessment of a stock and more. Zacks Excel Link also works with custom databases used by more advanced quant departments.